While asset condition may not be the first thing on a CFO or Finance Director’s mind, a clear understanding of an asset’s investment story and its ability to meet a business requirement should be top of mind when considering investment decision making and depreciated replacement cost.

Finance departments, especially in asset intensive organisations, should care about having a strong asset investment story. The foundations of this story is an intimate knowledge of the financial risk associated with an asset and how its condition impacts safety, performance and delivery of value back to the organisation.

Why should finance care?

- Having extensive asset condition information simplifies investment decisions that are naturally a complex exercise.

- Working together with asset management teams allows finance departments to make better decisions around the need for capital (CAPEX) investment or improving asset condition through operating expenditure (OPEX).

- Making sound investment decisions between CAPEX and OPEX will help avoid unnecessary capital intervention and improve managing the trade-offs between cost, risk and performance.

Having a good grasp of asset condition is important as it allows the need for investment to be quantified and the risks and benefits of an intervention to be objectified in the business case. Through robust and predictive asset condition data, the timing, the type and the cost of intervention can also be optimised.

Failing to have clear answers around asset condition, failing to invest, failing to invest at the right time or failing to respond with the appropriate interventions can have significant and costly consequences.

What is your asset investment story?

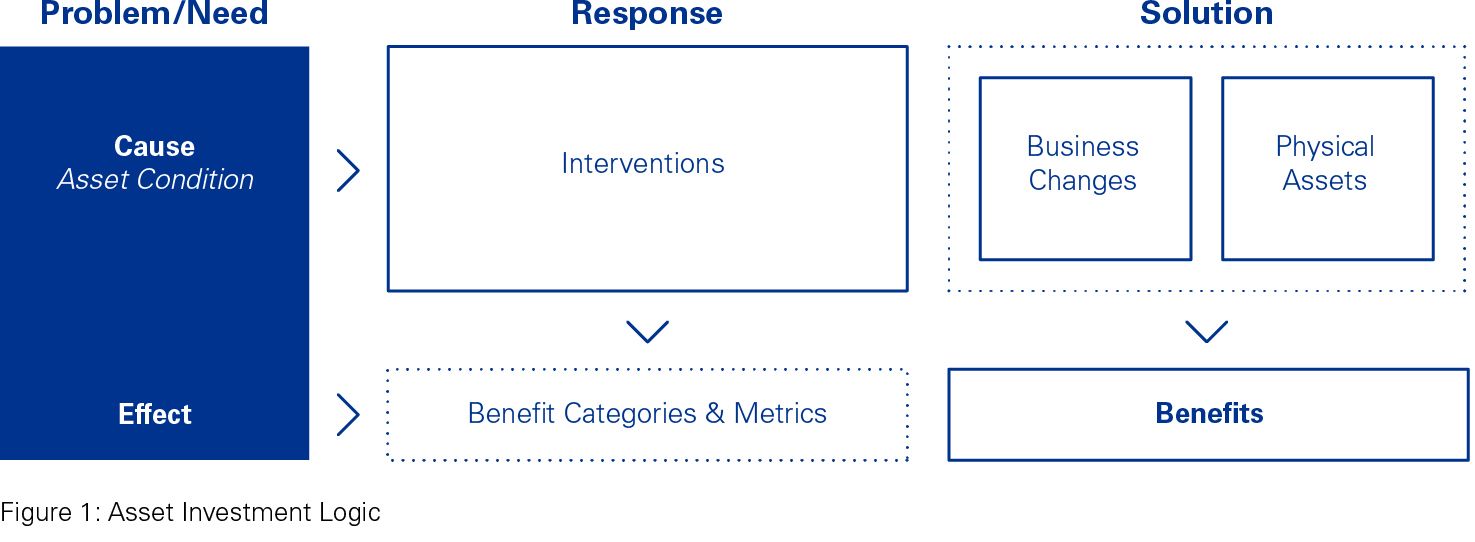

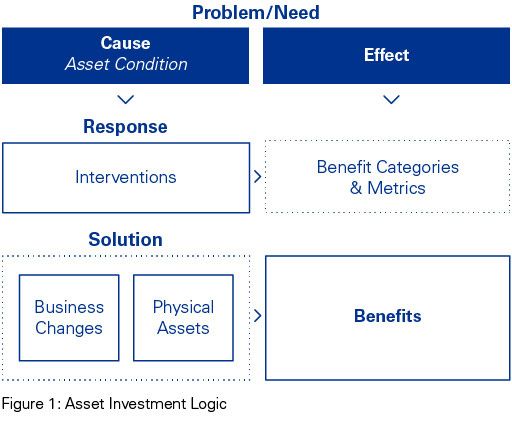

Establishing investment logic around four key pillars (problem, benefit, response and solution) is the key to a connected and sequential structure of a good investment story, linking asset condition to a successful investment.

Three considerations to a successful asset investment story

1. Predictive asset condition strategy – asset sampling

Identifying the need, type and timing for asset investment can be greatly enhanced through a statistically driven asset sampling strategy. This strategy relies on smarter and more accurate asset inspections that improve information and insights into asset condition across large distributed asset populations. This is done by identifying the unique sub-populations and complexities that exist within an asset type. The complexity of an asset can then be used to rank its criticality and inform the number and preferred samples that will be required to determine the condition and remaining useful life of an overall asset type, with the required precision.

KPMG Australia has developed a predictive asset condition strategy that is insightful and powerful for organisations with a large distributed asset base, like many government organisations.

2. Linking asset condition to Treasury funding

For public sector finance departments, asset investment proposals must describe how a proposed asset investment is the most effective and efficient means of supporting the delivery of departmental outputs, and meeting government objectives.

Investment proposals must consider alternative options such as leasing, outsourcing and operational solutions. It should also consider total cost of ownership of the asset and the implications on output performance such as quantity, quality, timelines, revenue and expense. Asset investment proposals should be supported by sufficient documentation and analysis and be reflective of government goals and priorities.

In addition to evaluating investment artefacts such as business cases, Treasury is also interested in asset information, such as current asset condition, remaining useful life and the current output performance of assets. Sources of funding are also important to Treasury. Alternative sources of funding such as proceeds from asset sales are considered high priority, provided it is relevant to the proposal being considered. Using asset condition to more accurately determine factors important to Treasury, including book value of an asset, is highly beneficial to the investment story.

To add to the complexity, a finance department should be particularly focused on how asset investment stories and proposals come together at the initiative, program and portfolio or organisational level. The key to optimising asset investment alignment is if these levels connect and the logic of a single investment can be easily tested within the broader organisational context to manage asset portfolio performance, risk and cost trade-offs.

3. Cross-functional alignment

The international standard ISO/TS 55010:2019 – guidance on the alignment of financial and non-financial functions in asset management – provides direction on how to maximise value derived from assets. Alignment and coordination between financial and non-financial business functions can lead to the resolution of many of the core asset related issues facing executive management.

Improved expression of asset criticality and risk in financial terms through an asset condition assessment will assist in providing more robust risk controls and improved options analysis.

Funders (such as the Treasury) of asset-intensive organisations will be more informed and armed with decision-enabling information to assist with:

- integrated strategic planning

- asset lifecycle planning

- capital investment planning and the budgeting process

- articulating short, medium and long term views of asset funding requirements.

How KPMG can help

KPMG can support improved asset investment outcomes by linking our predictive asset condition strategy to successful investment stories. To this end, we have developed the KPMG Asset Register Analytics Solution (KARAS) to help our clients manage and leverage the value of their fixed asset data. The digital solution enhances asset portfolio management and decision-making capabilities through an informed understanding of business risks and opportunities by providing:

- Detailed internal and external reference points (benchmark) to challenge management's assumptions.

- Situational modelling to identify inconsistent records and determine value impacts of adjustments to asset effective lives and total cost of ownership.

- A visualised summary report to provide cross-portfolio visibility and identify company-wide asset portfolio trends and risks.

- Portfolio management to easily review assets and quantify and qualify risks and opportunities in a client's fixed asset portfolio.

Clients will not only have an opportunity to identify areas to improve their cash flow, but also potentially improve depreciation charges and CAPEX forecasting. By identifying trends, risks and patterns asset management can be enhanced by better understanding where assets are located, their condition, their remaining useful life, current performance levels and key areas requiring investment.

The case for the finance department to sit up and take note of asset condition is clear. Defining inputs for investment decisions is critical and finance departments need to work with other functions to ensure the right information is collected in a targeted and systematic way to inform robust and defensible conversations and decisions.