On 12th December 2023, the UAE Federal Tax Authority (‘FTA’) issued a Corporate Tax Guide on the Taxation of Extractive Business and Non-Extractive Natural Resources Business.

This guide provides general guidance to any Person that is carrying on an Extractive Business and/or a Non-Extractive Natural Resource Business in the UAE. It explains the following:

Expression |

Definition |

Natural Resources |

Water, oil, gas, coal, naturally formed minerals, and other non-renewable, non-living natural resources that may be extracted from the UAE’s territory. Natural Resources do not include renewable resources such as solar energy, wind, animals, and plant materials. |

Extractive Business |

The Business or Business Activity of exploring, extracting, removing, or otherwise producing and exploiting the Natural Resources of the State or any interest therein as determined by the Minister. An Extractive Business is conducted through a right, concession or Licence issued by a Local Government. |

Non-Extractive Natural Resource Business |

The Business or Business Activity of separating, treating, refining, processing, storing, transporting, marketing or distributing the Natural Resources of the UAE. A Non-Extractive Natural Resources Business is conducted through a right, concession or Licence issued by a Local Government. |

2. Conditions to qualify as an Exempt Person under the Corporate Tax Law

No. |

Expression |

Extractive Business |

Non-Extractive Natural Resource Business |

1 |

The Person directly or indirectly holds an interest in a right, concession or Licence issued by a Local Government to undertake the Extractive Business/Non-Extractive Natural Resource Business, in the UAE. |

√ |

√ |

2 |

The Person is effectively subject to tax under the applicable legislation of the Local Government |

√ |

√ |

3 |

The Person has made a notification to the Ministry of Finance in the form and manner agreed with the Local Government |

√ |

√ |

4 |

The Person’s income from its Non-Extractive Natural Resource Business is derived solely from Persons that undertake a Business or Business Activity (for example, B2B) |

|

√ |

3. Directly or indirectly holding or having an interest in a right, concession or Licence

A company can either directly hold a Licence issued by a Local Government or indirectly operate and benefit from such a Licence through partnerships, collaborations, or joint ventures.

4. Contractors, subcontractors or suppliers

The Corporate Tax exemption for an Extractive Business/Non-Extractive Natural Resource Business does not extend to other Persons such as contractors, subcontractors or suppliers that do not in their own right meet the conditions to be exempt.

5. Exceptional cases of failure to meet conditions of Exempt Person

If the conditions are not satisfied at any time during a Tax Period, the Person will generally cease to be an Exempt Person from the beginning of that Tax Period. However, an Exempt Person may continue to be an Exempt Person, or cease to be an Exempt Person from a different date, if the conditions discussed below apply.

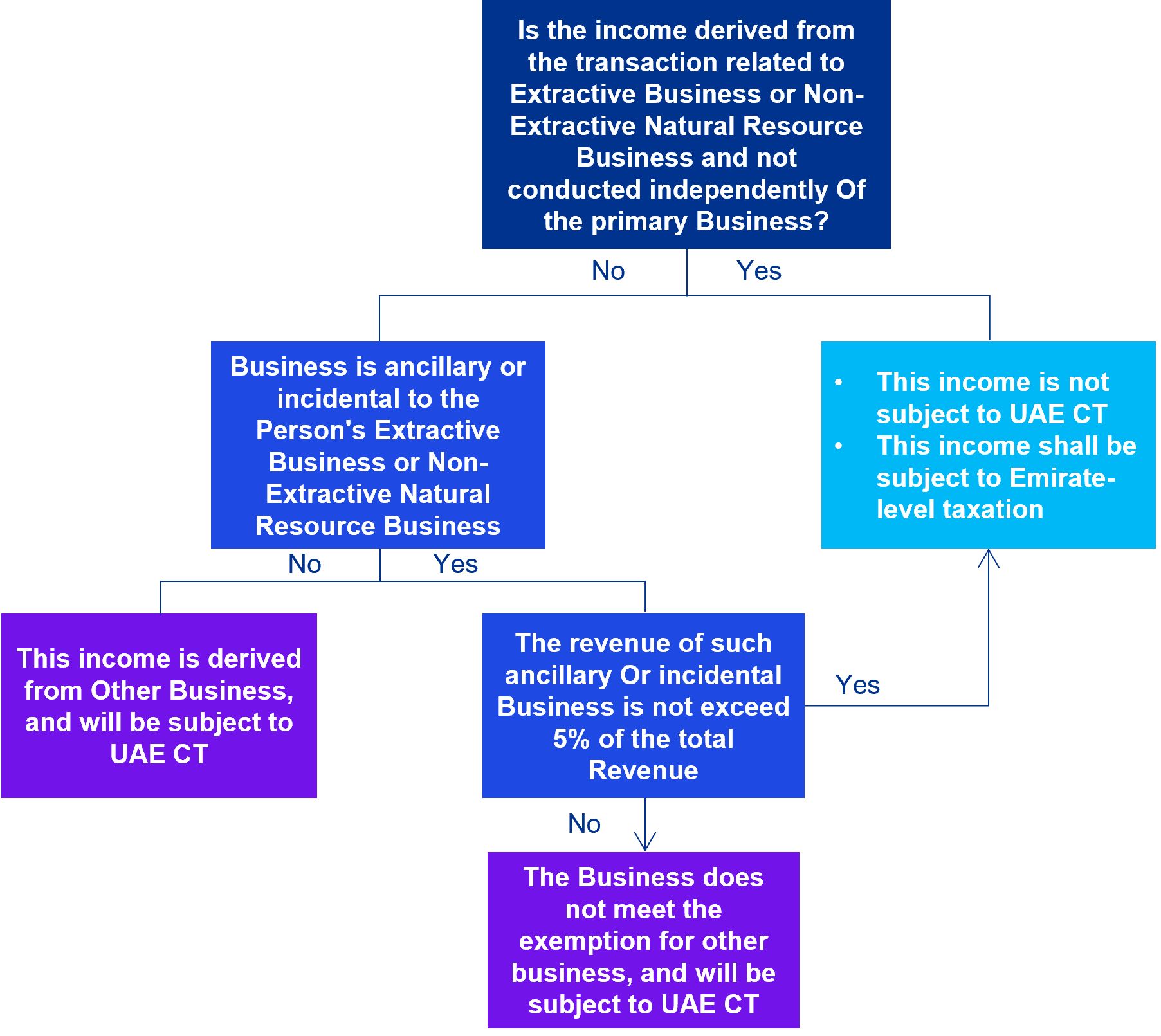

6. The approach to identifying the ‘Other Business’ and Exemptions for Other Business

Click the image to view the approach.

7. Determining Taxable Income of ‘Other Business’

If the other Business is treated as an independent Business, the Person should maintain its Financial Statements separately. The other Business should be treated as a distinct and separate entity operating in its own right. The books of accounts, income, expenditure, payable and receivable balances, etc. should be determined separately.

For certain expenditures relating to both the Extractive/Non-Extractive Natural Resource Business and the taxable other Business (i.e. common expenditure), an appropriate apportionment method needs to be established.

8. Compliance requirements

An Exempt Person is required to maintain all records and documents that enable the FTA to ascertain the exemption status for a period of seven years following the end of the Tax Period to which the exemption is claimed.

9. The CT Guide also provides several examples of the following:

- Directly or indirectly holding or having an interest in a right, concession or Licence

- Contractor, subcontractors or suppliers

- Ancillary or incidental test

- Treatment as a separate entity

These examples facilitate the understanding of certain issues where there has been some interpretation uncertainty.

Even though the Guide is not legally binding, it is a valuable source of information for better understanding the nuances of Extractive Businesses and Non-Extractive Natural Resource Businesses.

The full guide is avaialble here - FTA guide (PDF 402 KB)

KPMG has a dedicated Corporate Tax team that will be delighted to help you assess the impact of the updated legislation in your operations and activities.