Date of the update

August 2022

In brief

In August 2022, the UAE Federal Tax Authority published a new User Guide on Excise Tax for Clearing Companies, focusing on Consumption, Import and Release transactions, and public clarification EXTP008 about the calculation of financial guarantees for the Excise Tax in Designated Zones. The FTA has also made minor changes to a number of existing Excise Tax guides.

1. Summary of the User Guide for Clearing Companies

The newly issued User Guide aims to support the Clearing Companies by answering the following key questions:

- How to suspend Excise Tax upon import

- How to release suspended Excise Tax for goods that have been exported

- How to declare consumed goods

- What are the Excise Tax Suspension compliance obligations?

The User Guide also provides a detailed explanation of what type of declaration, and how and when the Excise Tax Clearing Company should complete and submit to the FTA.

Conditions

- Clearing Companies are required to declare excise goods that are to be imported into the UAE on behalf of the importer.

- Clearing Companies are also required to declare the excise goods that are consumed in the UAE.

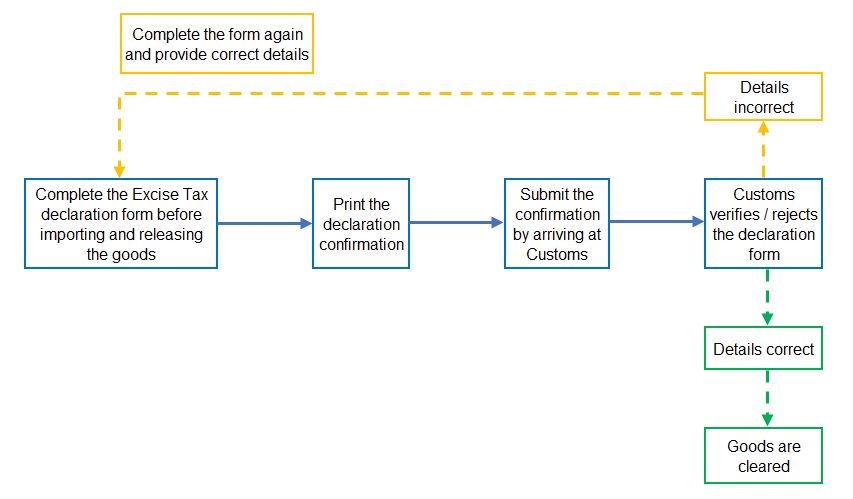

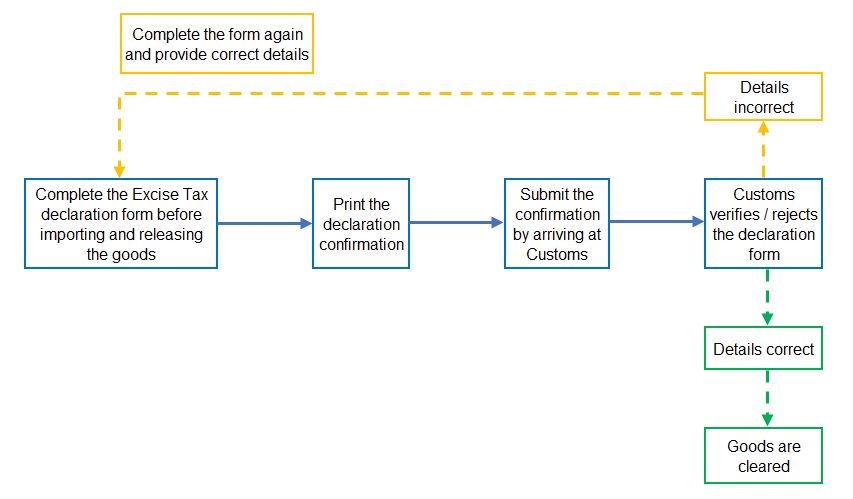

Schematic overview

Below is the overview of the process that each Excise Tax Clearing Company (TINCE) shall follow in order to declare excise goods on behalf of the importer and to have the goods cleared through Customs. The process applies every time the excise goods are imported.

The new service is already available on Federal Tax Authority Portal – E-Services.

2. Summary of Public Clarification EXTP008

- In 2017 the financial guarantee was decided in line with industrial best practices since there was no compliance history.

- From September 1, 2022, the compliance history within the last five years will decide the amount of the financial guarantee.

- Maintaining a good compliance history will reduce the financial guarantee amount.

Conditions

- All warehouse keepers are required to provide a financial guarantee for each designated zone.

- The amount of the financial guarantee will be decided based on the Taxable Person’s Compliance History.

The way forward

The FTA has defined a four step process to calculate the amount of the financial guarantee:

Step 1: Guarantee based on excise tax due on the average month-end stock over a period of 12 months.

Step 2: Calculation of the financial guarantee percentage based on multiple factors.

Step 3: Preliminary financial guarantee amount.

- The rate calculated in step 2 will be applied to step 1 to decide the preliminary financial guarantee amount.

Step 4: Determining the guarantee amount with respect to the specific designated zone by adjusting the preliminary guarantee amount if either the minimum or maximum threshold applies.

- The minimum financial guarantee amount is AED 175,000.

- The financial guarantee is capped at AED 25 M (subject to specific conditions)

The new service is already available on Federal Tax Authority Portal – E-Services.

3. Other minor changes to existing guides

The FTA also published an updated version of the Non-Registered Excise Stock Movement User Guide previously published in December 2020, which shows a step-by-step approach to how Warehouse Keepers must declare the stock movement of Excise Goods. In the new version, there are only minor changes on how to navigate the e-Service portal (e.g., added illustration on how to search for non-registered stock movement declaration).

Similarly, the FTA has also released a new version of the Excise Tax Import Declaration User Guide with only minor technical system updates (e.g. tax period/date drop list, search button, etc).

We will be happy to discuss the implications, potential solutions, and the required next steps for your specific scenario. Please get in touch with your usual KPMG contact or any of the contacts below.

Contact us

Connect with us

- Find office locations kpmg.findOfficeLocations

- kpmg.emailUs

- Social media @ KPMG kpmg.socialMedia

Stay up to date with what matters to you

Gain access to personalized content based on your interests by signing up today