Banks are suffering today as large provisions will be needed given the scale of the impact of Covid-19 on infrastructure assets—especially those linked to commodity prices. While it is true that pandemics like this one are black swans; given the long term nature of project finance loans, their economics must be robust for projects to survive and thrive in such situations.

Even considering a scenario in which the pandemic had not occurred, banks, especially in emerging markets, are saddled with large infrastructure loans which are turning into bad debt. Thought needs to be given to the root cause of this. The challenge will be further exacerbated in this decade as technology risk will make certain elements of the infrastructure chain obsolete, resulting in stranded assets in the bank portfolio.

Based on our decades of experience in financing infrastructure projects in over 50 countries, we have identified ten guiding principles aimed at avoiding these pitfalls.

1) Avoid name lending

Many banks fund projects merely on the basis of the strength of the promoter, and their perceived ability to implement a project. Whilst this is a fundamentally important point and deserved attention, it is not the only reason to finance the project. The use of limited recourse financing with appropriate risk mitigation strategies in place for the various elements of the risk that a project bears is key and must be strictly adhered to. We have explored this in detail in a previous article in this series.

2) Risk mitigation is key

Whilst designing a limited recourse financing structure, appropriate risk mitigation is vital. At the heart of the structure lies the special purpose vehicle (SPV) into which the equity is subscribed. It is an example of a limited recourse structure as banks will not have access to the sponsor balance sheet to repay the loans. This makes it imperative for the SPV to not have any unallocated project risks, which typically include construction risk, operating risk, and offtake risk, among others, as depicted by the diagram above. Each type of risk must lie with the party best suited to take that risk; for example, the construction risk should lie with a competent engineering procurement construction (EPC) contractor with adequate experience. The operation and maintenance (O&M) contract should be allocated to a reputable O&M contractor, and in the case of a power project, the offtake power purchase agreement (PPA) should be with a credit-worthy utility.

All contracts should be “back-to-back” so that no unallocated risk lies in the SPV. Incorrect risk allocation, even if it is back-to-back will result in defaults. For instance, we have observed projects where governments have been asked to share construction risk with the EPC contractor, or back wind forecast risk in a wind project. These are all examples of incorrect risk allocation as government is not the best party to take this risk; it’s best able to take the risks it can manage, for instance political force majeure in host country, or payment for its utilities which it controls. Correct risk allocation; focusing on limited recourse finance structures, will help avoid default and also direct banks away from mere name lending.

3) Don’t lawyer a project to death; focus on the data and demand supply analysis

The 1990s saw a slew of privatizations in the Asia Pacific region, including Dabhol in India, Paiton in Indonesia, and Mezuhan in China. These examples had access to some of the world’s best lawyers able to draw up excellent documentation, yet they were all restructured despite this as the tariff was too high. The focus was not on economics but on over-engineering the project documentation whilst the projects were not viable economically. However Meghnaghat and Haripur in Bangladesh were not restructured as tariffs were low and power plants continue to dispatched.

The clear lesson from this is to focus on retaining economic viability even if contractual documentation is strong, to ensure that projects are not renegotiated. This is even more critical now given that technological risk will lead to many projects becoming stranded; the key lies in low tariffs and a high merit order position of the system grid. The of tools like big data and data analytics will become increasingly important.

4) Capital structuring is key

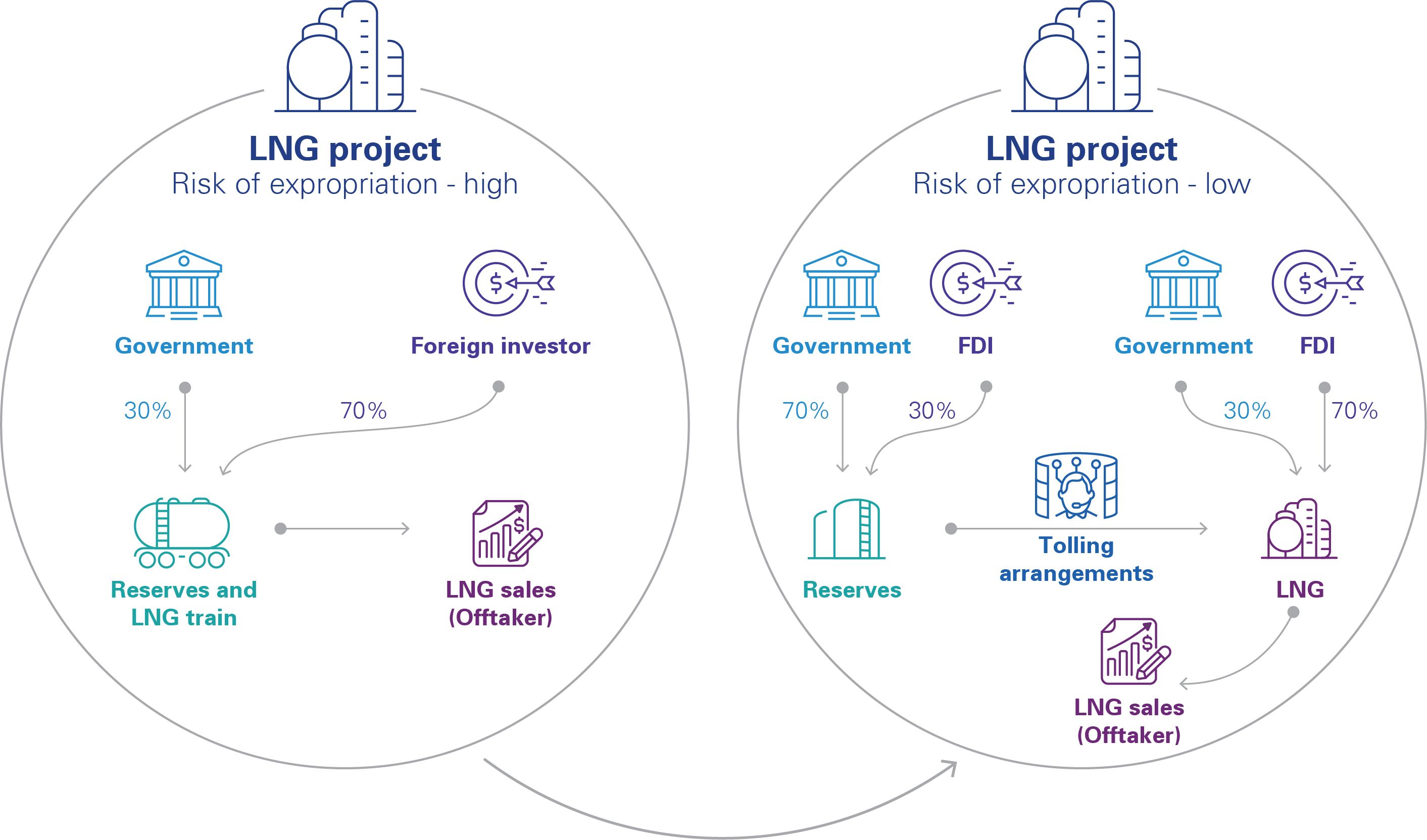

It is extremely important to have the right stakeholders in the projects. Involvement of local partners and domestic government financial institutions as minority shareholders is a vital risk mitigant. Banks should only finance projects where the anchor sponsor has sufficient experience in the industry. Expropriation risk, which is a key risk of default, is higher in extractive industries like upstream oil and gas and mineral projects, and lower in Infrastructure projects like power and toll roads. Foreign ownership in extractive industries must be balanced to avoid this risk. Tolling structures work well to avoid risk of exportation. Consider two methods to structure a LNG project which involves foreign ownership and gas extraction. Structure A poses a higher risk of expropriation than Structure B. Careful thought needs to be given whilst designing structures to ensure defaults are avoided.

5) Big is no longer best

The traditional concept of going in for large projects to achieve economies of scale is no longer optimal, defying the basic principle of economics of the marginal cost of production decreasing as size increases.

The reason for this lies in the technological implosion into infrastructure causing many assets to become stranded. Large gas-based plants and other mega power projects will get stranded when lower cost projects in wind and solar come to the forefront. Hence to mitigate this risk, stakeholders would be advised to build modular plants; in increments, keeping an eye on possible disruption caused by technological innovation.

6) Avoid mismatch of tenor of debt with project contracts; leverage is key with strong covenants to control it

This is one of the main causes for projects failing. When construction of projects is started without long term finance in place, shorter term debt is used with the hope to refinance. Projects should be structured to avoid excessive leverage.

Strong covenants in the term sheet linked to debt service coverage ratios, dividend blocks at appropriate levels of DSCR, and strong probabilities of default should be factored in.

7) Technological obsolescence will have a seismic impact on the sector.

In the past decade, banks, while lending to infrastructure projects, and equity providers while executing these projects, have been able to price risk correctly and obtain a satisfactory return. However, this is unlikely to remain the case in the next decade due to the impact of technological disruption. Innovations include 5G, blockchain, big data, 3D printing, nanotechnology, autonomous and electric vehicles, robotics, artificial intelligence and smart city innovations. There are a number of effective ways for mitigating technological risk.

The concept of a stranded asset factor should be taken into account, and infrastructure and asset classes should be rerated. Investors demand a greater return for higher levels of risk, so as the risk constitution of each product changes, it will have a knock-on effect on expected return. This leads to repricing of loans. There appears to be a high chance of contracts being renegotiated, giving rise to the need for emphasis on effective communication with stakeholders. Financing smaller, modular projects may be more lucrative than ambitiously large ones, as it would be easier to implement continuously evolving technological innovations when dealing with projects with smaller time-frames.

Efficacy insurance may be used to protect lending institutions. When new technology does not perform in the way it is expected to, insurers may be able to foot the cost. However the risk can only be hedged by insurance if the outcome of the technology is scalable and quantifiable, and a clear economic model exists.

The principles of renegotiation should be agreed upon upfront, at the signing of the concession agreement, in order to be able to preserve returns during the life of the investment and to ensure adequate debt service.

The technological impact of infrastructure and appropriate ways of mitigating it is explored in detail in a previous article in this series.

8) Sustainability and social benefits of the project will come to the forefront; stakeholder management is key

Stakeholder management is key in insuring against defaults. Even though there are a large number of projects which may benefit from the best documentation and the best economics in place, those that survive the test of time will be those which manage stakeholders well. Projects that contribute to community benefits and which score highly on the sustainability agenda, and contribute to job creation, will inspire confidence amongst sponsors.

9) There is insufficient usage of political risk instruments

For emerging market projects, there are a number of risk mitigation tools available. Examples include the partial risk guarantee cover by the World Bank and the IFCB loan, political risk cover including contract frustration and non-honoring of sovereign debt by MIGA, and the MeD 18 facility by EBRD. As these institutions have much greater leverage in negotiating issues with governments than sponsors.

Using these instruments not only forces risk mitigation at the project level (as only then will they be issued) but also acts as a deterrent to host governments against unnecessary expropriation of projects or payment default, as these institutions have much greater leverage in negotiating these issues than sponsors. Hence it would be wise to use these instruments as part of the financing plan.

10) Executing projects in a flawed PPP framework poses significant challenges

While PPPs provide sufficient capital for infrastructure, projects are frequently not completed satisfactorily due to incorrect risk allocation. It is important that this is done correctly. Risk mitigation needs to be carried out within the framework of three main tiers:

· Correct unbundling of infrastructure;

· consideration of regulations and public policy;

· appropriate risk mitigation at project level.

Unbundling involves breaking up the individual elements of the infrastructure chain into those that are monopolistic in nature – which require regulation – and those that fall under the umbrella of a free market. There are two main methods: vertical and horizontal. Vertical unbundling is simply the separation of functions. The horizontal method is a topographical separation: all functions within a particular area are controlled by a single entity, with another entity controlling all functions in a different geographical location.

Monopolistic elements of the chain are those that require regulation, where the barriers to entry are high. Regulation may take the form of one of two forms: US cost-push inflation, and price-cap regulation. With the cost-push inflation method, the capital cost of the entity is calculated and the return is determined. Meanwhile price-cap regulation, or CPI-X, subtracts the expected efficiency savings from the rate of inflation, measured by the Consumer Price Index (CPI). As the CPI takes into consideration a wide range of organizations within the economy, it is a valid comparative measure, and the preferred method of regulation in most jurisdictions.

After the macro privatization principles are understood and applied, the company typically forms special purpose vehicles (SPVs) to contend with different elements of risk, for instance construction risk or operation risk. Revenue allocation is then carried out, usually to operating costs and debt service.

The principles of risk mitigation have been explored in detail in a previous article in this series.