In the past decade, infrastructure has remained a fairly stable asset class. Default rates have been low. Even with the lower default rates, recoveries have been high. Banks, while lending to infrastructure projects, and equity providers while executing these projects, have been able to price risk correctly and obtain a satisfactory return. However, this is unlikely to remain the case in the next decade due to the impact of technological disruption, which will have a seismic impact on the infrastructure sector.

For example, a toll road will not behave as a normal toll road under conventional traffic density study modelling when autonomous vehicles are considered. Similarly, the dynamic of ports will change when 3D printing is factored in.

In this article, we aim to address the impact of new innovations on infrastructure and ways to mitigate the risk from both a debt and equity perspective.

The diagram below displays the 15 forces of technological disruption that will affect the sector.

A brief overview of some of these technologies is given below.

- 5G: With real-time data transfer capabilities, 5G will enhance remote use applications by obviating the limitations of lags in information sharing. High bandwidth and low latency from 5G will improve data capture and data access across project delivery processes. Increased visibility may inform decision-making in the design phase, potentially reducing the need for future renovations. 5G will also help organizations inexpensively deploy technology to quickly capture, organize and analyze large volumes of video information. This may reduce the need for some teams to be present onsite. Real-time, rich, visual information may provide reassurance to the owner of the project and an on-demand transparent view of the project at any moment in time.[i]

- Blockchain: Blockchain applications range from crowdfunding of power projects to enabling flexi-grid systems and interoperability applications for transportation mobility. Its distributed ledger technology may allow streamlining the time-consuming, expensive processes of selecting, vetting and managing relationships in complex global supply chains.[ii]

- Big data: Big data solutions enable real-time collection of data from infrastructure asset operations, with a wide range of applications for the management, financing, maintenance and operating of assets. Big data from weather, traffic, and community and business activity can be analyzed to determine optimal phasing of construction activities. Geolocation of equipment also allows logistics to be improved, spare parts to be made available when needed, and downtime to be avoided. Energy conservation in malls, office blocks and other buildings can be tracked to ensure it conforms to design goals. Traffic stress information and levels of flexing in bridges can be recorded to detect any out-of-bounds events. This data can also be fed back into building information modeling (BIM) systems to schedule maintenance activities as required.[iii]

- 3D printing: 3D printing offers a vast range of applications for the construction of infrastructure assets, as well as for the production of spare parts for asset maintenance and repair. For example, it has the potential to transform the way ports operate. Instead of shipping the precast and raw materials when a structure needs to be duplicated in another location, the advent of 3D printing means that only the digital blueprint needs to be sent to the relevant person at that location, using 5G technology. The structure can then be assembled onsite. 3D printing may be used in disaster zones.[iv]

- Nanotechnology: Advances in the application of nanotechnology and emerging nanomaterials in construction and engineering are likely to profoundly impact the project development landscape. It has a vast range of applications in the quest for developing durable, economic and sustainable highway infrastructure. Nanomaterials can be used to engineer construction materials, be used in road pavements, and improve their geotechnical properties.[v]

- Autonomous and electric vehicles: Electric vehicles (EV) and Autonomous vehicles (AV) entail markedly different requirements for the design, development and provisioning of transport infrastructure from conventional transport due to their operating requirements. However both have manifold societal benefits, ranging from more efficient public transport and freight services, to cleaner cities with more room for people and green spaces.

- Robotics: Existing robotic technologies deployed in construction such as motion control, navigation and computer vision are expected to be augmented with complex physical and cognitive tasks in both the construction and operations of infrastructure assets. There are construction robots for brick-laying and masonry, and robots that lay an entire street at once, dramatically improving the speed and quality of construction work. Demolition robots may be slower than demolition crews, but they are safer and cheaper.[vi]

- Artificial intelligence: Deep learning capabilities and modelling applications have implications for designing, constructing and operating infrastructure assets. They are also relevant to pricing risk and asset performance management. Virtual reality goggles and sending mini-robots into buildings under construction can help track work as it progresses. AI may be used to design the routing of electrical and plumbing systems, and develop safety systems at work sites. AI may be used to pursue real-time interactions of machinery, workers, and objects on site, and alert supervisors of potential safety issues, productivity issues, and construction errors. It may lower the frequency of expensive errors, reduce the number of worksite injuries, and make building operations more productive.[vii]

- Smart city innovations: Officer wearables include, for instance, devices that equip police officers with real-time information may enhance their decision-making capabilities. Vehicle to everything (V2X) connectivity would enable cars to communicate with other cars, transport infrastructure, and pedestrians. Solar powered, sensor-equipped smart trash bins would enable waste collectors to track waste levels so they can make informed decisions, influencing fuel usage.

Having studied the impact of technology on infrastructure, we now explore ways to mitigate this risk. In addition to the traditional ways of limiting risk in a limited recourse financial transaction (highlighted in our previous article), there are five key principles to focus on from a technological risk mitigation perspective.

Development of a stranded asset factor (SAF)

A stranded asset occurs when a change in environmental circumstances renders a previously successful asset unviable or redundant from a technological or financial perspective. For example, the tariff for a coal fired power purchase agreement may have been relatively low when it was set up. However, solar technology has now become cheaper, leading to gradual obsolescence of coal powered energy generation, making it a stranded asset.

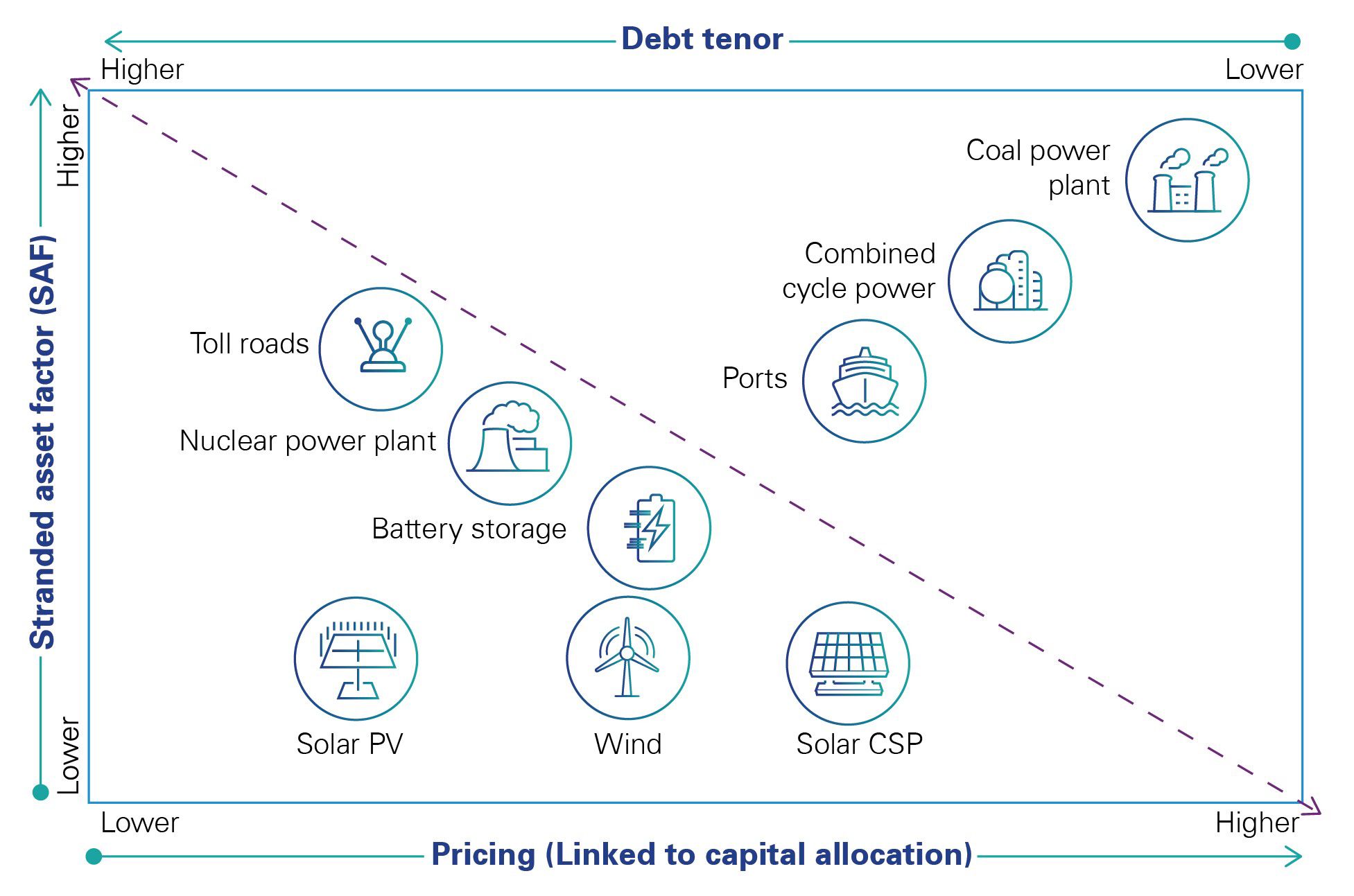

Using big data and other tools available, a SAF should be developed for different assets in different jurisdictions. For example, the SAF of the power sector may be high for different elements of generation, but low in toll roads. The graph below depicts this.

While big data and modeling will ultimately need to prove this, intuitively, from this graph, it can be seen that coal powered generation, and combined cycle gas-based power plants, will have a high SAF, and hence the pricing of debt should be higher and the tenor of the loan lower. Similarly, solar and wind power have lower SAFs, thus pricing should be lower and tenor longer. Toll roads and ports hover somewhere in the middle. It is evident that the rerating of risk and return in the sector is well due.

Different SAFs will therefore need to be developed for different segments of infrastructure. Return on equity and debt pricing will need to be different for these elements, ensuring an adequate risk return trade off.

Infrastructure and asset classes will be rerated as different levels of capital will need to be provided at appropriate pricing for different levels of risk. Investors demand a greater return for higher levels of risk, so as the risk constitution of each product changes, it will have a knock-on effect on expected return.

This leads to repricing of loans. The price of a loan is based upon the percentage rate of return. The interest rate comprises the risk free rate (RFR) as well as a risk component. The rate of return is linked to the risk component, which indicates the lender’s willingness to invest in the project. Standard factors considered when determining the rate of return include country risk, asset class and technology risk, and are calculated on a 40 basis point scale.

Stakeholder management

Effective stakeholder management is one of the key factors for risk mitigation when technological disruption occurs. There will be a high chance of contracts being renegotiated, giving rise to the need for an emphasis on effective communication for all stakeholders concerned. Projects’ contribution to societal benefits, environmental benefits, and job creation, will be key in driving down the price and the success of the renegotiation process, should it occur. The importance of this should not be underestimated.

Big is no longer best

The conventional economic theory of establishing large projects to achieve economies of scale to drive down the marginal cost of production, no longer holds true in the era of technological disruption. Building large gas-based projects and nuclear plants will result in high stranded asset factors. Building infrastructure in modular blocks over time, while keeping an alert eye on the technological innovation curve is the optimal way to transition, from a debt financing and equity investment perspective. Solar and wind power, and battery storage all fit within this principle and will help keep the SAF low.

The use of efficacy insurance

In addition to the traditional methods of insurance used extensively in projects, a new tool called efficacy insurance is evolving and represents a powerful tool of risk mitigation for both equity providers and lenders. The insurance industry understands technological risk better than banks and can cover lenders for technological non-performance when newer technologies are introduced. Solar, battery storage, and biofuels are examples where this tool can be effectively deployed.

Principles of upfront renegotiation in contracts

There is little doubt that given the pace of disruption, and the price of infrastructure being driven down exponentially, existing concession contracts will be renegotiated. It would be wise to agree upon the broad principles of renegotiation upfront, at the signing of the concession agreement, in order to be able to preserve returns during the life of the investment and to ensure adequate debt service.

The future of infrastructure is dynamic and exciting. Organizations and stakeholders would do well to prepare for it by fully understanding the impact of technological risk, being able to articulate it, considering mitigation principles, and pricing it correctly.

Sources

[i] https://www.pbctoday.co.uk/news/bim-news/5g-construction-worksites/62274/

[ii] https://www.iaasiaonline.com/blockchain-in-manufacturing-risks-and-benefits/

[iii] https://www.thebalancesmb.com/how-the-construction-industry-is-using-big-data-845322

[iv] https://www.boldbusiness.com/infrastructure/3d-printing-manufacturing-impact/

[v] https://www.researchgate.net/publication/269410825_Nanotechnology_as_a_Preventive_Engineering_Solution_to_Highway_Infrastructure_Failures

[vi] https://www.robotics.org/blog-article.cfm/Construction-Robots-Will-Change-the-Industry-Forever/93